hawaii capital gains tax exemptions

The difference between how much is withheld and how much is owed is the amount of your refund. In cases where you paid all of your GE TA and capital gains taxes owed to Hawaii and the income tax owned to Hawaii on computed capital gains are less than the amount withheld you can file for a refund of the HARPTA withholding.

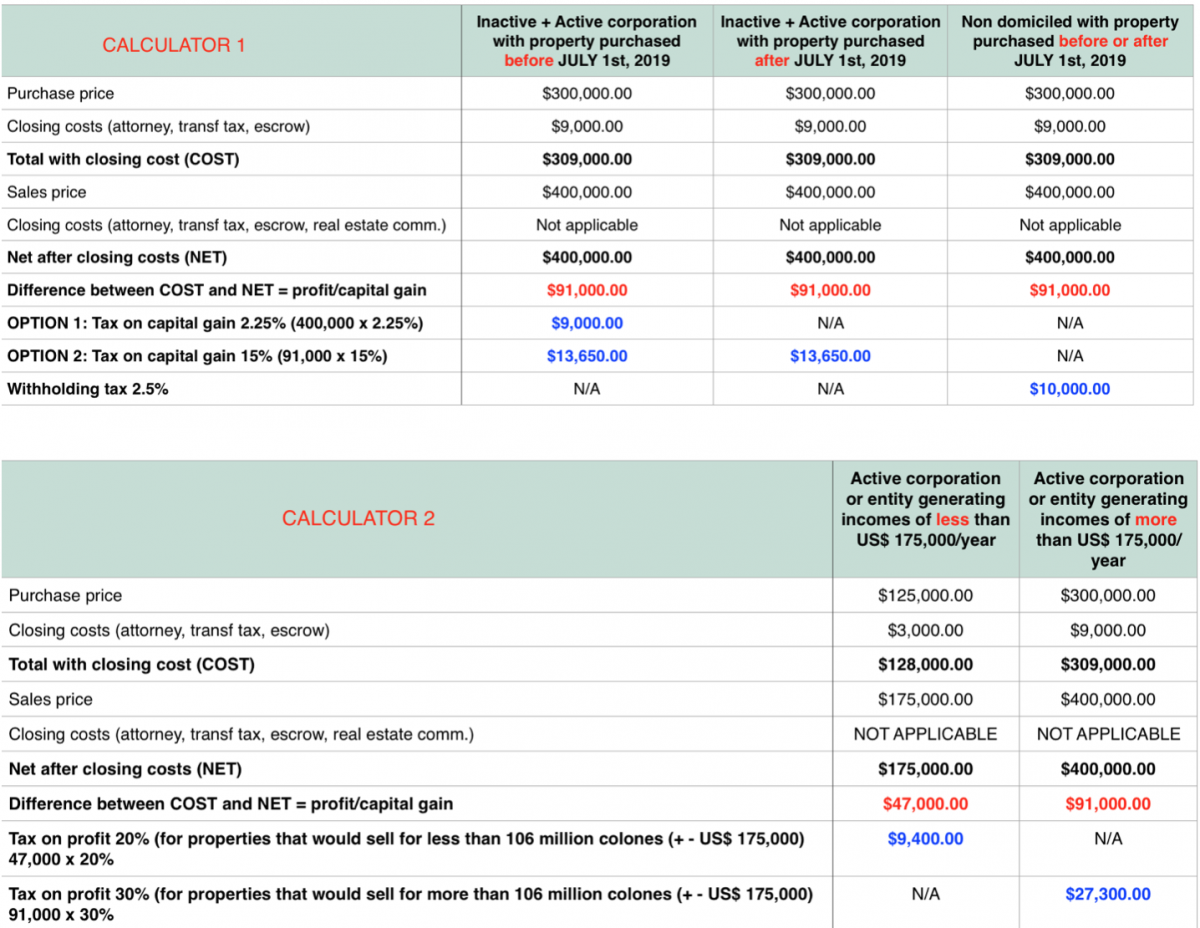

Capital Gain Tax In Costa Rica Remax Ocean Surf Sun

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status.

. 830 Punchbowl Street Honolulu HI 96813-5094 Open Hours. Please remember that the income tax code is very complicated and while we can provide a good estimate of your Federal and Hawaii income. A short-term rate same as your income tax rate and b long-term rate for respective 2018 income brackets filing in 2019.

Hawaii law requires all closing agents to withhold 725 of the sales price from the proceeds of non-resident sellers. Deduction of 50 of capital gains or up to. Increases the tax on capital gains.

13 Corporate income tax. Claim for Tax Exemption by Person with Impaired Sight or Hearing or by Totally Disabled Person and Physicians Certification. Generally only estates worth more than 5490000 must file an estate.

There are many but somewhat rare exemptions to. Capital gains are currently taxed at a rate of 725. The rate that the transfer is taxed at depends on its value.

But this might require some waiting. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. Most are exempt from HARPTA withholding because of Federal exemptions which Hawaii recognizes.

Hawaii Capital Gains Tax. The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. You do this by filing a non resident Hawaii Income Tax form known as Form N15.

The exemption for tax year 2021 is 549. FIRPTA is in addition to the HARPTA withholding. PART I Short-Term Capital Gains and Losses Assets Held One Year or Less a.

Hawaii taxes gain realized on the sale of real estate at 725. This applies to all four factors of gain refer below for a discussion of the four factors. In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed above.

Under the Hawaii Real Property Tax Act HARPTA Hawaii residents and non-residents alike must pay capital gains tax realized on the sale of real property unless the gain can be excluded under Hawaii income tax law. For Hawaii residents transferring under 600000 the rate is 01 of the value or 015 for non-residents. The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring.

Besides capital gains tax the depreciation recapture tax gets added to the tax bill. Uppermost capital gains tax rates by state 2015 State. Uppermost capital gains tax rates by state 2015 State.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. Increases the tax on capital gains. Hawaiis capital gains tax rate is 725.

Changes to Schedule A itemized deductions. The exemption for tax year 2021 is 549. If you are married and file a joint return then it doubles to 500000.

100 shares of Z Co b. Gain is determined. Capital Gains and Losses and Built-in Gains Form N-35 Rev.

121 Capital Gains Exclusion Tax Exemption still applies to exclude gains of up to 250K for an individual tax filer or up to 500K for married filing jointly. 2016REV 2016 To be filed with Form N-35 Name Federal Employer ID. Exhibit 2- 2018 shows.

From 712021 through 6302023 temporarily repeals certain general excise tax exemptions. You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. Blind deaf or disabled persons 7000.

The amount withheld can be 2 3 even 10 times more than justified. What is the actual Hawaii capital gains tax. Increases the personal income tax rate for high earners for taxable years beginning after 12312020.

OBSOLETE Miscellaneous Fee Payment Voucher. Some absentee owners are exempt from the HARPTA law. However the fact that an owner may be exempt from the HARPTA law does not also exempt the owner from paying state capital gains taxes that may be due Hawaii.

112 Capital gains tax. Increases the corporate income tax and establishes a single corporate income tax rate. Formerly 10 until 2162016.

PART I Short-Term Capital Gains and Losses Assets Held One Year or Less a. The rate slowly goes up in seven iterations until you reach the highest rate which is 1 for property transfers of 10000000 or more and 125 for non-residents. Deduction of 50 of capital gains or up to.

Hawaii taxes capital gains at a maximum rate of 725In order to insure collection of this tax and any other taxes you owe may owe the state. Kind of property and description Example. It requires a withholding of 15 of the sales price not of the gains.

This is not a tax. You do this by filing a non resident Hawaii Income Tax form known as Form N15. 808-587-1418 Toll-Free for the hearing impaired.

Exhibit 2- 2018 shows marginal capital gains tax rates. FIRPTA applies when you dont live in the US at the time when selling your Hawaii property. That applies to both long- and short-term capital gains.

Capital Gains Tax in Hawaii. The 38 marginal Medicare surtax was eliminated effective 112018. The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring states in 2015.

Log into your Hawaii Tax Online account to renew your permits. Many non-residents dont realize that they are subject to Hawaii taxation and dont file a Hawaii income tax return or pay. You will be able to add more details like itemized deductions tax credits capital gains and more.

The Hawaii capital gains tax on real estate is 725. STATE OF HAWAIIDEPARTMENT OF TAXATION SCHEDULE D FORM N-35 Capital Gains and Losses and Built-in Gains. 15 Estate and inheritance taxes.

Long-term gains are those realized in more than one year. FIRPTA is a federal law 26 USC.

Top 5 Hawaii Homeowner Tax Deductions Hawaii Real Estate Market Trends Hawaii Life

Solved Can You Avoid Capital Gains Taxes On A Second Home

How Do State Estate And Inheritance Taxes Work Tax Policy Center

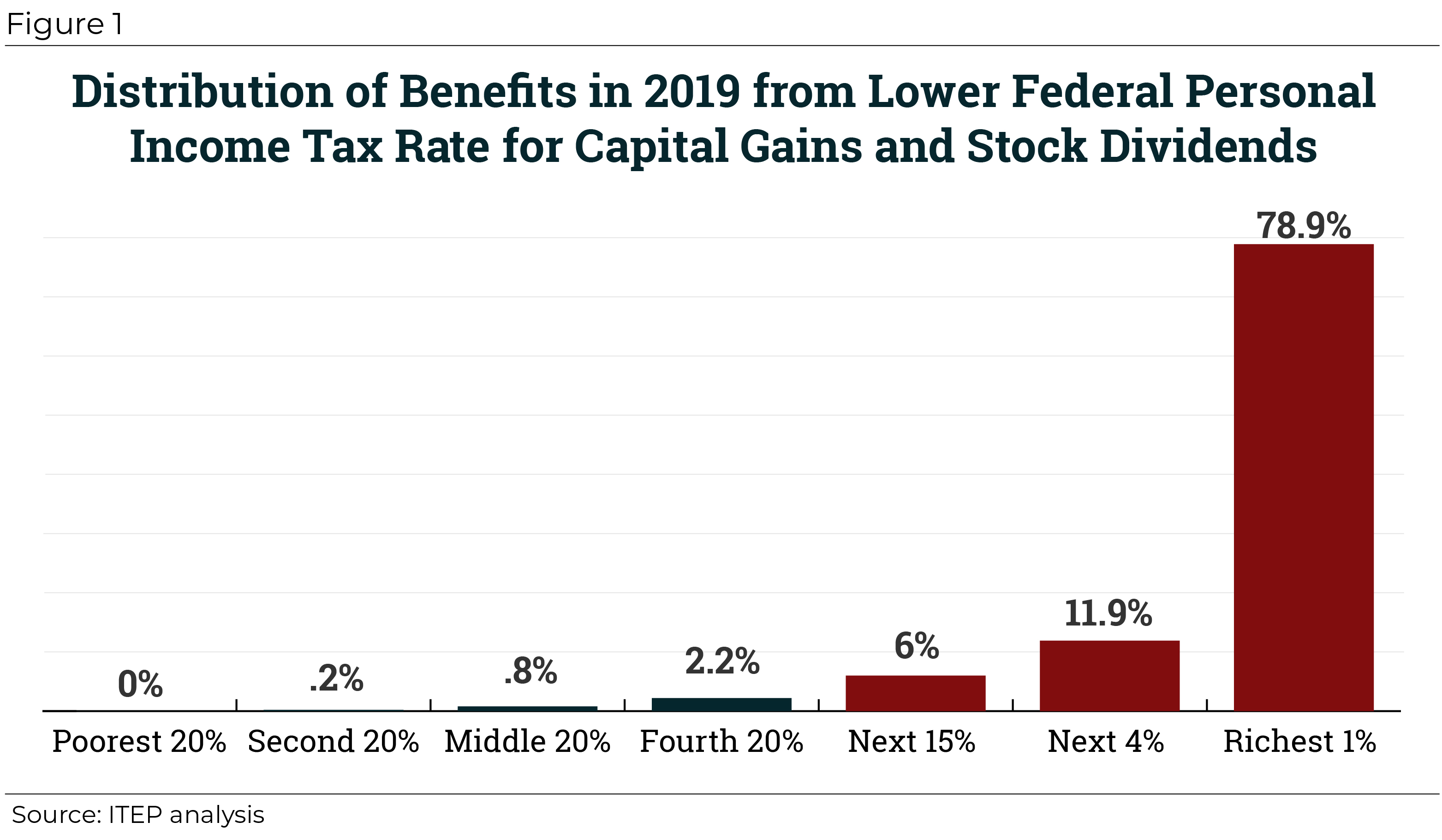

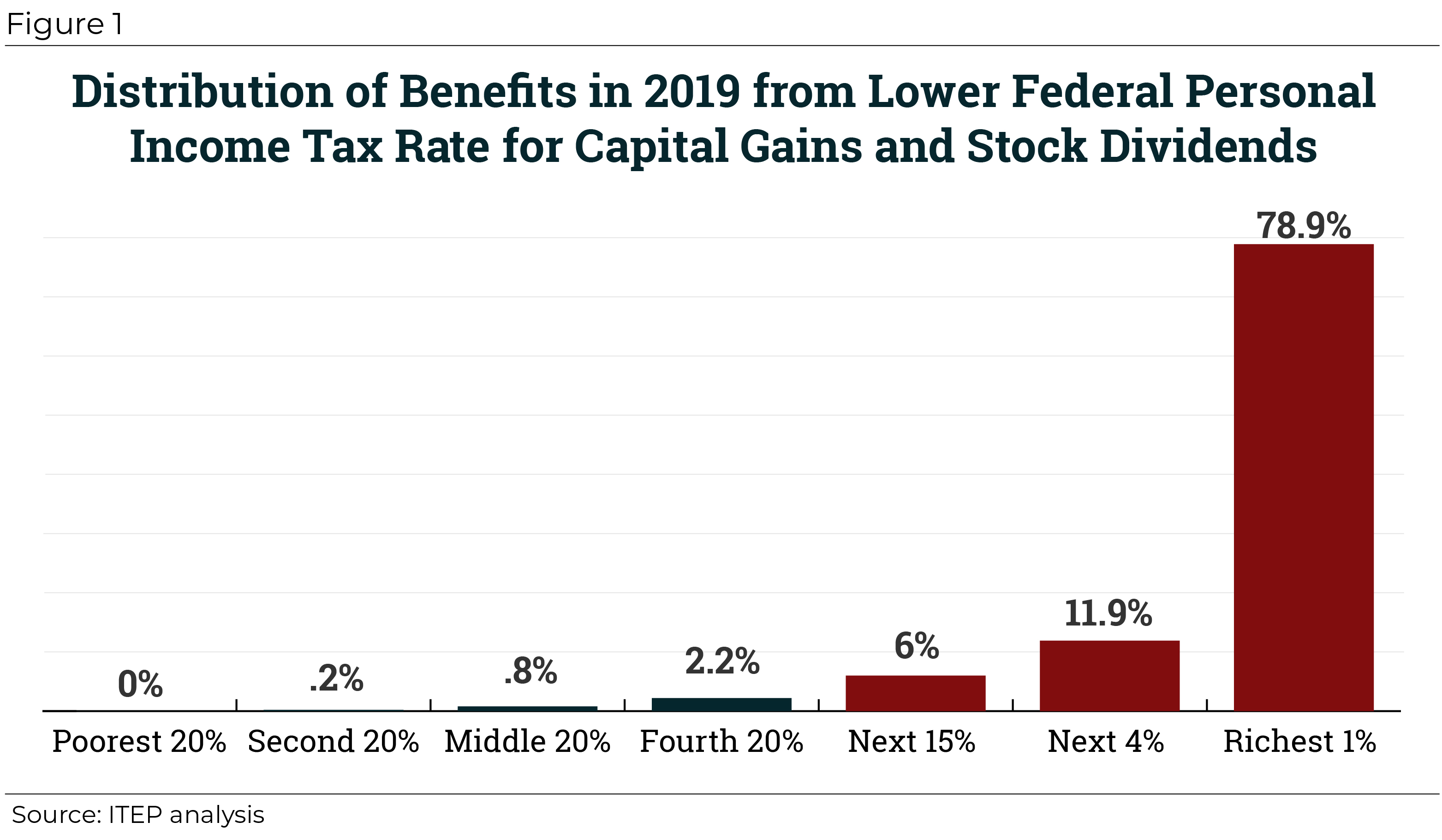

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

State Taxation Of Capital Gains The Folly Of Tax Cuts Case For Proactive Reforms Itep

Solved Can You Avoid Capital Gains Taxes On A Second Home

Tax Rules When Selling Your Home Hawaii Financial Advisors Inc